Top Capital Allowances Opportunities

- Bryan Crawford

- Feb 1, 2022

- 5 min read

Whenever we are asked to examine balance sheet additions or the tax treatment of underlying construction invoice arrangements we often come across the same repeated patterns which can lead to missed or substantially under reported claims that can cost businesses many thousands (sometimes millions) of pounds.

Set out below are the most common areas of opportunity in balance sheet and construction project tax analysis: -

Professional Fees

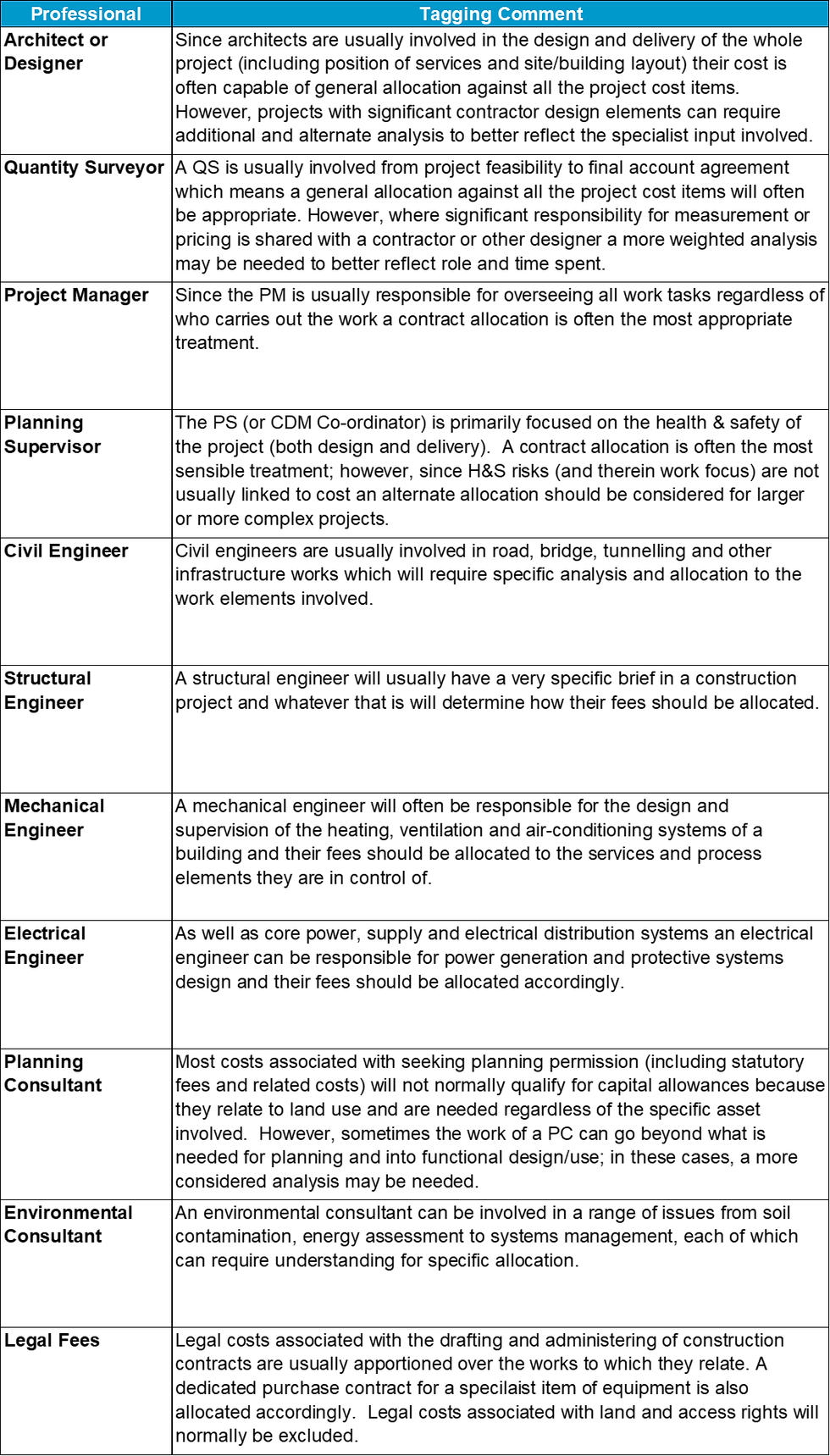

The treatment of professional fees is similar to the treatment of preliminaries in that they require to be understood and matched (or tagged) to the underlying purpose or asset(s) to which they relate (qualifying or non-qualifying). Sometimes this can involve a simple contract allocation but more often a specific analysis is needed to better reflect the range of professionals and different roles involved.

The development of an infrastructure asset such as a transport hub or off-shore windfarm can have a very different mix of specialists compared to a hi-tech manufacturing facility or typical commercial building project.

Another challenge with professional fees is that an accurate split for contract allocations may only be possible after the project is complete and final costs for the underlying qualifying elements are known. This means claims are often only capable of finalisation many months, in some cases years, after the first fee is paid and interim claims for larger projects can require careful management and additional reporting requirements.

Construction Preliminaries Allocation

Construction prelims are the cost of administering a project and providing general plant, site staff, facilities, and site-based services and other items not included in the detailed or measured schedule rates. Costs can be significant and can vary widely between projects (typically 10% to 20% of the construction contract).

The cost of plant and machinery includes cost associated with their provision (i.e. design, transport, and installation). An example of a cost that is deemed too far removed and will not normally qualify for capital allowances is finance (Ben-Odeco Ltd. v Powlson, 52TC459).

The case of JD Wetherspoon v. HMRC Commissioners [2012] UKUT 42(TCC) discussed preliminaries in detail and confirmed that tax relief should only be available against the item to which the preliminaries cost relates.

In practice and for most cases, particularly for smaller projects, an apportionment of the preliminary’s costs should be reasonable and acceptable to HM Revenue & Customs (HMRC), but it is important to remember that complex or larger projects can require a more detailed analysis.

Projects with unusual features, such as difficult ground conditions, façade retention works, land reclamation or sophisticated components can have more prelim costs weighted to cover these elements. A single project can also be part of a phased development with upfront preparatory and prelim works weighted accordingly. Like so much in tax, determining the context of expenditure can become very important to getting the right and optimum tax treatment.

An apportionment should only be used where the facts support it, and a more considered allocation is not possible, practicable or economic.

Only normal site preparatory work for buildings and structures should be included in a capital allowances claim. Land reclamation and other related works will not normally qualify. Claims for Land Remediation Relief (e.g. hazardous substance treatment) should only include costs that would not have been otherwise incurred which means the inclusion of general works prelims (and fees) are not normally appropriate.

Capitalised 'Operational' Costs

Many business 'capitalise' a range of costs associated with the operation and improvement of their properties for financial reporting and commercial reasons. Doing so does not usually affect their tax treatment but it can have important implications on the timing of any relief.

Aside the special rules for things like Corporate Interest Restrictions and Lease Premiums the starting point for most expenditure in fixed asset additions is to determine its genuine 'capital' or 'revenue' status and business purpose for tax purposes.

Genuine 'capital' expenditure (i.e. that is linked to the creation of a new or substantially improved asset) may be considered for capital allowances treatment (if it can meet the relevant qualifying criteria) but if it is deemed too remote (e.g. financing fees) or disallowed by statute (e.g. land access arrangements) no tax deduction may be due.

Genuine 'revenue' expenditure (i.e. that is linked to the maintenance/operation of an existing asset) does not lose its character for tax purposes; however, 'capitalising' it means the business will only receive tax relief as it is amortised (depreciated) in the businesses accounts (no depreciation = no relief).

There is one exception to the above and it relates to significant services ('integral feature') replacement in an existing property. If a maintenance contractor replaces large parts (50%+ cost) of a buildings heating, air-conditioning, electrical or lifts installation the expenditure will automatically be regarded as falling into the capital allowances rules instead of 'revenue' treatment.

Joinery Quotations

Routine maintenance by a joiner to an existing property will normally be 'revenue' and deductible in line with the businesses accounting treatment; however, 'capital' invoices can cover a range of works with varied capital allowances (e.g. plant and machinery or structures and buildings allowances) treatment.

This is because a joiner can be involved in both the structural carcass of a building (walls, floors and ceilings) as well as fitted furniture (counters, shelves, seating, units, display cabinets, wardrobes etc.) which means an underlying analysis of the quotation (with follow up) is almost always beneficial.

General Building Work Quotations

A builder (in much the same way as a Joiner) can be involved in a range of works and one of the biggest challenges arises in claims for Structures and Building Allowances (SBAs). An SBA claim cannot include plant or machinery, land remediation/reclamation works, or expenditure that is not 'capital'.

This means a partial analysis is simply not sufficient for any business that wishes to claim SBAs; most general building works will have a range of tax treatments that will need investigated and analysed.

The good news is that if a business uses the same supplier(s) for multiple projects it may be possible to reduce analysis by adopting a sampling based approach.

Non-Qualifying Property Acquisitions

A fresh analysis of non-qualifying property acquisitions can lead to hidden claims. The Commercial Property Standard Enquiries (CPSEs) which accompany most commercial property transactions are often incomplete when it comes to capital allowances and a response of 'not applicable' is not unusual. This means additional investigative analysis is almost always needed to determine whether a claim exists.

Claims for expenditure that has previously been treated as 'non-qualifying' are rarely lost and the accumulation of such costs over many years can lead to significant repayments of tax as well as future deductions.

If you would like learn more on this, or any other tax related topic, please contact us.